Fundamental analysis lacks systematicity, specifically referring to the forex market’s fundamental analysis, as stock market fundamental analysis has already achieved high systematicity. Graham’s “Security Analysis” laid the foundation for stock fundamental analysis.

However, the forex market’s fundamental analysis has not had a good foundation, leaving many forex traders at a loss when faced with complex news and unsure how to interpret existing forex commentary. For forex fundamental analysis, renowned expert Kathy Lien has made significant contributions, but unfortunately, her work has not been continued by others.

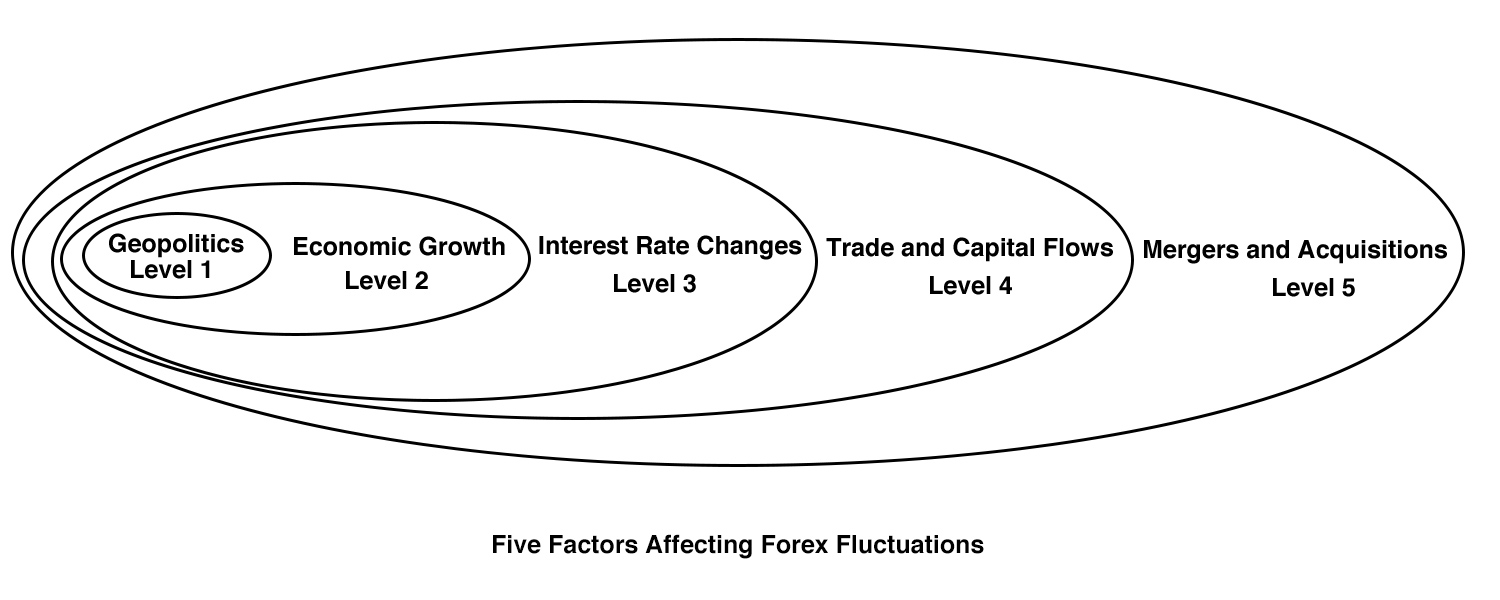

However, these factors are not equally important; thus, we introduce NLP’s logical levels to rank their importance, as shown in the figure below.

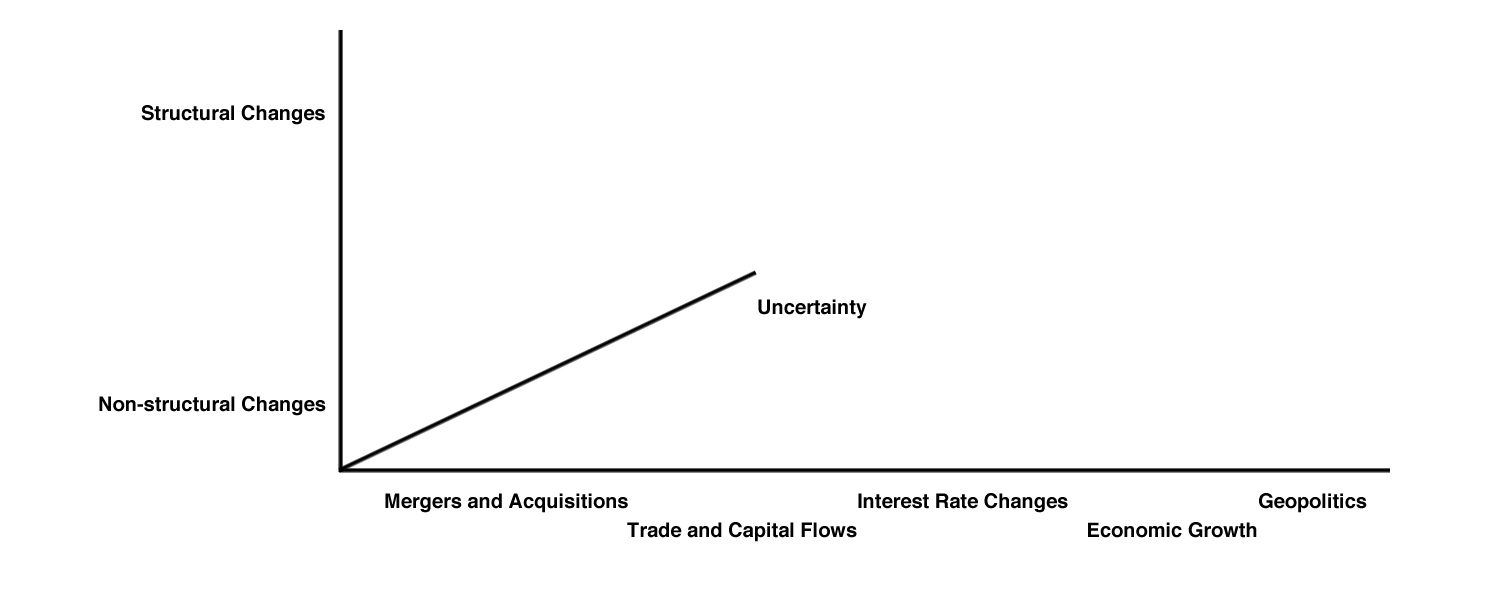

Of course, knowing the importance of elements is not enough; we also need to know if there has been a structural change in an important factor. For example, you know that interest rates have risen, but if they have entered a long-term rate hike channel, it represents a structural change, meaning its impact on exchange rate fluctuations is continuous.

Therefore, when analyzing the five driving factors, we need to consider both structural changes and their importance. An event may be very important but cause only temporary price movements due to its non-structural nature; another event may be very important and cause ongoing fluctuations over time due to its structural nature. For example, a single rate hike is non-structural, entering a rate hike cycle is structural; the former causes temporary exchange rate fluctuations, while the latter leads to sustained movement; for instance, an unexpectedly strong GDP data release for one quarter is non-structural, but if multiple quarters show economic recovery, it’s structural—the former causes temporary movement in exchange rates while the latter leads to structural changes.

There might also be a “speculative trend” structure where after news is released, exchange rates rise (or fall) rapidly forming an uptrend (or downtrend) before reversing and stabilizing at the bottom (or pressured at the top) followed by a long uptrend (or downtrend). This scenario combines both structural and non-structural changes where speculators quickly take profits from short-term gains using positive news and exit after trend traders interpret structural changes and enter the market pushing prices to reasonable levels before exiting.

The logical levels of driving analysis only indicate differences in importance among five driving factors. In contrast, the “Dina Forex Fundamental Analysis Matrix” adds two dimensions: structural change discussed above and certainty/uncertainty. The more uncertain the important data, the greater its impact.

Exchange rates move before significant data or events based on incomplete information or expectations. Strong uncertainty creates room for speculation and leads to larger expected movements. Uncertainty means imagination space; the larger it is, the bigger the movement until further imagination space ends—usually because actual data shatters expectations.

From the figure above we see that the driving analysis matrix includes three dimensions “structural change - importance - certainty level,” with “importance” being the most crucial dimension hosting five levels of driving factors. When conducting driving analysis, you usually quickly scan some released information and analyses consciously placing them into the “Dina Forex Fundamental Analysis Matrix.” In this three-dimensional coordinate system, the larger the volume a point constructs, the greater its overall impact worth tracking—whether it’s a potential hotspot or an emerging or mature hotspot—thus advancing driving analysis into psychological analysis.

Next, let’s look at some specific categorizations mainly based on importance while gradually considering certainty level and structural change positioning. Here are quick placements after reading some instant news and commentary:

News A: BNP Paribas SA stated this week that due to worsening UK fiscal conditions increasing risks of downgrading sovereign debt ratings combined with recent instability dampening foreign investor enthusiasm predicts GBP/USD will slide 12% in 2010. Citigroup points out that market concerns about public finances and uncertainty over 2010 election results may dominate GBP fate in coming months.

News B: Last Friday, the euro suffered collateral damage from the lira’s collapse and the strengthening of the dollar. It fell about 120 points during the session, dropping from a high of 1.1527 at the opening on Friday to just above 1.1400 at the close. Data from the Bank for International Settlements shows that Turkish borrowers owe $83 billion to Spanish banks, $38 billion to French banks, and $17 billion to Italian banks. These concerns led to a roughly 3% drop in the stock prices of major European banks on Friday, dragging down stock indices across Europe.

Economic Growth: News A: Christina Romer, economic advisor, stated that although December’s employment data was a “step back” compared to November, the overall trend remains positive. The U.S. Department of Labor reported higher-than-expected unemployment numbers for December, but Secretary Solis indicated that legislation related to job recovery has helped the U.S. avoid a potential massive unemployment disaster.

News B: Before the 2008 financial crisis, China’s economic growth rate and labour productivity growth were significantly higher than those of the U.S., and there was considerable pressure for the renminbi to appreciate. Since the crisis, especially after 2012, China’s economic growth rate has shown a downward trend, labour productivity growth has slowed, and pressure for renminbi depreciation has emerged.

Interest Rate Changes: News A: Decision-makers at the Bank of England suggest that they may hold off on any action at least until February 2010. By then, new economic growth and inflation forecasts will be available, and the asset purchase program will expire. Most analysts expect that there will be no further expansion of quantitative easing, implying that the program will end next month. However, it will be some time before decision-makers have enough confidence in economic growth to start raising interest rates. After Friday’s non-farm payroll data release, U.S. federal funds futures indicated that the probability of the Federal Reserve raising interest rates by mid-2010 had decreased. The data showed a 22% chance of an interest rate hike by June 2010, down from 30% on Thursday.

News B: Economic growth in the eurozone has been relatively stable, with inflation rebounding somewhat, but inflation fluctuations have been significant in recent months, and further observation is needed to determine if there is an upward trend. The ECB’s July meeting made it clear that QE would end by year-end but was not resolute; if needed, reinvestment in maturing bonds would continue. Draghi mentioned that trade uncertainties still exist while expecting economic growth and inflation uncertainties to fade in the second half of the year.

Capital Flows: News A: The latest TIC report from the U.S. Treasury Department shows that as of July 2009, official holdings of U.S. Treasury securities and long-term bonds increased by $29.9 billion net. China holds $518.7 billion in U.S. debt, up $14.9 billion from June, remaining as the second-largest holder of U.S. debt. During the same period, Japan held the most U.S. debt at $593.4 billion, an increase of $9.6 billion from last month; with Britain being the third largest holder. Central banks increased their holdings out of necessity; otherwise, a decline in the dollar would lead to even greater losses.

News B: In July, banks reported a forex settlement deficit of 63 billion yuan; among these, bank-client and own foreign exchange settlements accounted for 2.9 billion yuan and 60.1 billion yuan deficits respectively. The large deficit in banks’ own foreign exchange settlements was the main reason for the overall deficit. The return to deficit in foreign exchange settlements in July is related to market entities delaying foreign exchange settlements and increasing foreign exchange purchases amid continuous depreciation of the renminbi; however, client foreign exchange settlement deficits were not significant. Additionally, an increase in foreign exchange reserves and foreign exchange holdings compared to last month, it indicates that cross-border capital flows remain generally stable.

Cross-Border Mergers and Acquisitions: News A: The largest acquisition related to the Australian dollar in August was the purchase of Australia’s Felix Resources by Yanzhou Coal Mining, China’s largest coal producer in the eastern region. Adam Boyton, a currency strategist at Deutsche Bank in New York, said, “Mergers are positive,” which helps with optimistic sentiment, but the current wave of mergers may be nearing its end. He also noted that the wave is more likely to explain the reasons behind the previous rise of the Australian and Canadian dollars, rather than future trends. Aroop Chatterjee from Barclays Capital said, “When we focus on the Canadian dollar, we should be interested in its Foreign Direct Investment (FDI) inflows.” Since last month, Barclays Capital has noticed the strong rise of the Canadian dollar and the continuous weakening of the Swiss franc. Switzerland’s Lonza Group AG has been actively acquiring in the chemical and biotech fields by borrowing Swiss francs as financing currency.

Notably, in August, the Canadian dollar weakened against the US dollar in the spot market, but analysts view this as profit-taking. Yuki Sakasai, an analyst at Barclays in Tokyo, wrote in a research report, “On the other hand, since these mergers are rarely initiated by companies from the US and Eurozone, they have little impact on the US dollar and euro.” The US dollar index rebounded in August, but this was mainly due to US companies selling their overseas assets.

News B: A consortium led by Chinese tycoon Li Ka-Shing acquired Germany’s metering and energy management group Ista for 4.5 billion euros, one of Germany’s largest acquisitions since 2009.

You must develop a habit of quickly categorizing news you see into one of five categories, ideally summarizing them in one sentence and writing it down. Once all information is quickly categorized, you can start evaluating from the most important information to peripheral information to determine whether the overall driving force is unilateral or oscillating; if unilateral, is it mainly rising or falling? At the same time, you can prepare some psychological analysis to see which driving factors are potential hotspots, which are emerging hotspots, and which are mature hotspots. This way you know to pay attention in advance to specific major trends coming. The method of observation is to see if potential hotspots appear among participants; market commentary and news will tell us if potential hotspots begin to spread while also checking if there is any action in price performance.