Nothing is permanent, just as good turns to bad, and bad turns back to good. Nature is fair, and there are always signs to watch for. These signs are signals that change is about to happen. If you notice these signs, you can start making necessary adjustments, either to brace for the loss of something passing or to use the opportunity to get out of a tight spot.

In forex trading, you must also remember that “nothing is permanent.” The fun and excitement of learning to trade won’t last forever, nor will the frustration of carelessness or loss. Trends that have started and provided substantial profits will not continue indefinitely. They all end, but the key is to find the signals that a trend is ending.

I. Forex Trading Trends

Forex trading is a financial game played 24 hours a day between bulls and bears, both fighting continuously to control the market. The struggle between bulls and bears drives the market in the form of trends—upward and downward.

If the candlestick chart is above the medium-term uptrend line, bulls control the market, with an 80% probability that the uptrend will continue.

If the candlestick chart is below the medium-term trend line, bears control the market, with an 80% probability that the downtrend will continue. However, no side can control the market forever. When the market decides to bounce up or pull back down, it will first break through the short-term downtrend line or fall below the short-term uptrend line.

To get green pips, you must choose a direction and hold a position in that direction. Once you enter the market, it’s essentially out of your control. You only have to learn to track the methods of the side controlling the market, whether bulls or bears, to profit consistently.

Fortunately, with a click of the mouse, you can switch sides at any moment of the 24-hour day, as often as you wish. Whether going long or short, both can be profitable. Even if you’re bullish in the morning, bearish in the afternoon, and bullish again at night, no one will consider you a traitor.

The forex market operates in trends, and if your trading direction aligns with them, then the trend is your friend. Why? The moment the trend starts piercing the trend line is also when you need to remember: nothing lasts forever. You should start watching for signs and realize that the trend may end soon. At that time, you need to tighten your stop-loss to protect profits, which is the correct way to hold onto what you have.

The chart below shows that the EUR/USD (4-hour chart) had been rising, bouncing after testing the uptrend line. After breaking the uptrend line, the bulls lost control of the market, and once the price fell below the trend line, the bears began to take advantage.

The market’s inclination shifts from bullish to bearish and vice versa, with trend lines inevitably being broken. If you were bullish in this chart and still held long positions when the market direction changed, then the market would take back all the profits it had given you.

II. Buying (Long) and Selling (Short) trades in Forex Trading

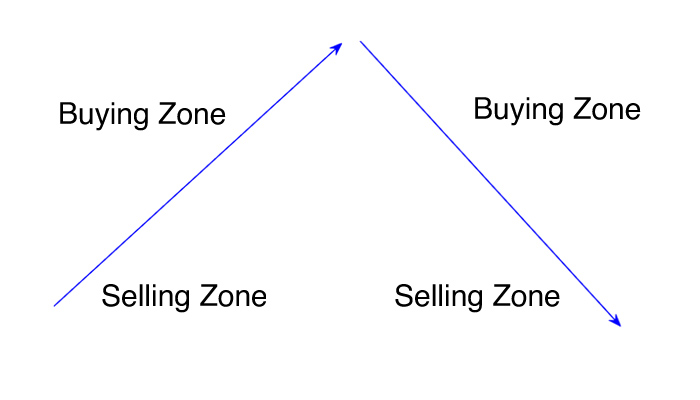

Trend lines are the dividing line between buying and selling zones. The buying zone refers to the area above the trend line, and the selling zone is the area below the trend line, whether it’s an uptrend or downtrend line (see the figure below).

When the market is above any trend line, it’s in the buying zone, and traders should look for the best positions to buy. When the market is below any trend line, it’s in the selling zone, and traders should look for the best positions to sell.

If forex traders hold long positions and the market starts breaking the trend line, whether short-term, medium-term, or long-term, they can consider exiting their positions or going short. If a long trader sees the market about to reverse, then the best position to start thinking about going short is after the market breaks the uptrend line and enters the selling zone.

III. Selling (Short) Zones in Forex Trading

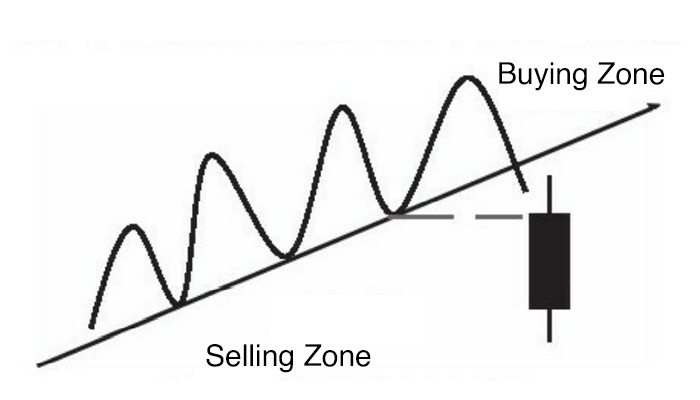

To help you truly identify the signs of a trend ending, I will explain step by step in detail. the first chart and the chart below both show bearish candlesticks entering the selling zone. However, an important point is that if the market enters the selling zone and immediately shows a bullish candle instead of a bearish one after breaking the trend line, then the market is still likely bullish.

Furthermore, if bullish candlestick patterns appear shortly after the forex market enters the selling zone, then there’s a high probability that the market is still in an uptrend, and the price may form a channel.

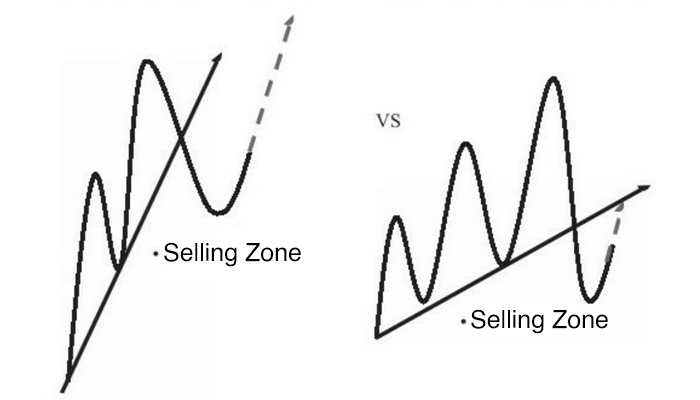

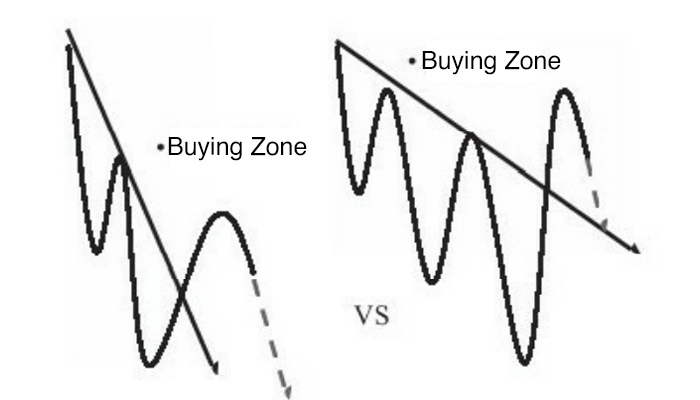

Additionally, consider the angle of the broken trend line (see the chart below). Traders’ thinking and behaviour should rely on probability, constantly focusing on high probability rather than low probability. When a trend line is pierced, and the market enters the buying or selling zone, the angle of the trend line largely determines the probability of a market reversal.

After the forex market breaks the uptrend line and enters the selling zone, the impact of the trend line angle should generally be examined. In the chart above, the broken uptrend line now acts as resistance. If the market starts to rise again, the price must first break through this trend line again.

If the right side of the broken trend line is lower than the last high point of the trend, then there’s an 80% probability of a downturn or reversal, as shown on the right side of the chart above; otherwise, the trend may continue to rise. In such a rise, the trend line as resistance also moves higher, as shown on the left side, and the trend may change to a channel form. However, if the right side of the trend line is lower than the last high point, then the greater probability is still a downturn, as shown in the chart below.

Once the trend unfolds in a channel form, the buying and selling zones will also change. In the chart below, the market enters the selling zone formed after the previous uptrend line was broken, which is also the buying zone formed by the new uptrend line. Entering the selling zone does not mean the uptrend is over.

On our website, you may have learned about short-term and medium-term trend lines, so if the short-term trend line is broken, the market is more likely to head towards the medium-term trend line and may bounce up after testing the medium-term trend line. The medium-term trend line is the most significant variable in the market.

The strongest signal of a trend reversal or the end of an uptrend is when the forex market pulls back to the nearest key support. When the market breaks the medium-term uptrend line, the probability of the uptrend continuing shifts from 80% bullish to 60% bullish, 40% bearish. When the market pulls back to key support, the market shifts from 80% bullish to 80% bearish.

IV. Entering the Selling Zone, Going Short

Although the forex market gives you a probability inclination, remember that the market can move in any direction at any time—it doesn’t care what direction you want it to move in at what time. Currently, the tools you have to predict the market’s next move include:

- Trading indicators and systems

- Candlestick patterns

- Support and resistance levels

- Trends and trend lines

- Buying and selling zones

Every trade carries risk, and every trade must comply with asset management principles. If you want to go short after the market enters the selling zone, then in case the trade is unfavourable, you must think about the potential loss. I’ve found that the best way to protect myself is to set the stop-loss order above the most recent high point (see the chart below).

You certainly don’t want to take greater risks, nor do you want the market to bounce back, but if the bulls do break through the previous high, then the trend may continue upward, clearing more high point resistance. The market may also form an ascending channel.

Therefore, if setting the stop-loss above the previous high point resistance still doesn’t comply with your capital management principles, then wait for the market to rise one last time and pull back to test the broken uptrend line before going short.

V. Buying (Long) Zones in Forex Trading

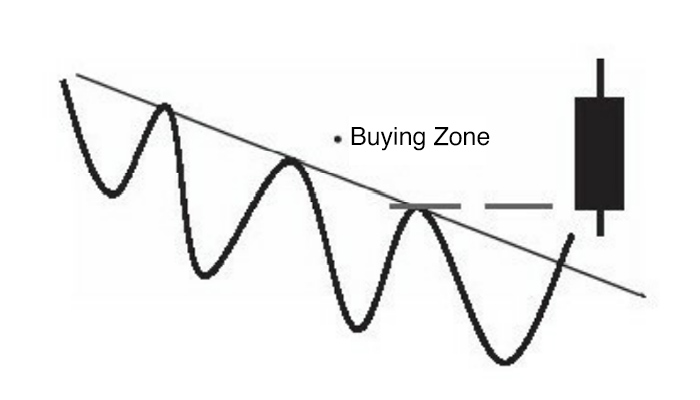

The buying zone is the opposite of the selling zone. I will explain step by step in detail how the forex market enters the buying zone. The chart below shows bullish candlesticks entering the buying zone.

However, an important point is that if the market enters the selling zone and immediately shows a bearish candle instead of a bullish one after breaking the trend line, then the forex market is still likely bearish (see the chart below).

A very important signal to consider is the angle of the broken trend line (see the chart below). The angle of the trend line, once pierced in any direction, largely determines the probability of a market reversal as the market enters the buying or selling zone.

After the market breaks the downtrend line and enters the buying zone, it’s a good habit to first examine the angle of the trend line. In the chart below, the broken uptrend line now acts as support. Whether the forex market continues to move downward depends on whether the trend line remains higher than the previous low point after being broken.

If the market starts to fall again, the price must first break through this trend line again. If the right side of the broken trend line is higher than the last low point of the trend, then there’s an 80% probability of an upward movement or reversal; otherwise, the trend may continue to fall.

In such a fall, the trend line as support also moves lower, as shown on the right side of the chart above, and the trend may evolve into a channel form. However, if the right side of the broken trend line is higher than the last low point, then the greater probability is still an upward movement, as shown in the chart below.

Interestingly, once the trend unfolds in a channel form, the buying and selling zones will also change. The market enters the buying zone formed after the previous downtrend line was broken, which is also the selling zone formed by the new downtrend line.

Entering the buying zone does not mean the downtrend is over. Don’t forget, if the short-term downtrend line is broken, then the market is more likely to head towards the medium-term downtrend line and then pull back down. The medium-term downtrend line is the most significant variable in the forex market.

The strongest signal of a trend reversal or the end of a downtrend is when the market bounces back to the nearest key resistance. When the market breaks the medium-term downtrend line, the probability of the downtrend continuing shifts from 80% bearish to 60% bearish, 40% bullish. When the market bounces back to key resistance, the market shifts from 80% bearish to 80% bullish.

VI. Entering the Buying Zone, Going Long

After the market enters the buying zone, you should enter the market going long and set a protective stop-loss below the last low point support (see the chart below).

VII. Summary of Buying (Long) and Selling (Short) Trades in Forex Trading

Identifying the buying and selling zones will greatly contribute to your trading success; however, not all trend line breakouts provide trading opportunities. To become an excellent technical analyst, you need to have a certain spatial awareness—being able to view trends from a three-dimensional perspective and anticipate the market’s future movements.

It’s important to remember that longer time frame charts control the trends of shorter time frame charts. Not all trends are clear, and not all buying and selling zones are clearly defined.

Therefore, when you can’t see the market direction clearly, stay out of the forex market.

Interestingly, common sense is sometimes not so common. However, since common sense exists, you should use it to assist your trading.

One summer, behind our office was a beautiful park with a stream and a pond for children to play in. One day, when I came to the office, a storm had come, and the once-clear stream was now a torrent, and the small pond was submerged. I said to myself, “Wow, the water was clear yesterday, but today it looks much more dangerous.”

If that small pond is where you like to swim and you plan to go there with friends after school, but you find the water murky and the current strong, would you still jump in?

I believe your common sense would tell you not to. The breakout of a trend line can strongly tempt you to enter the forex market and follow the new trend. However, as a trading novice, don’t enter the market for just one reason—find as many reasons as possible.

When in doubt, stay out!