I. Fundamental Analysis Data of Forex Market

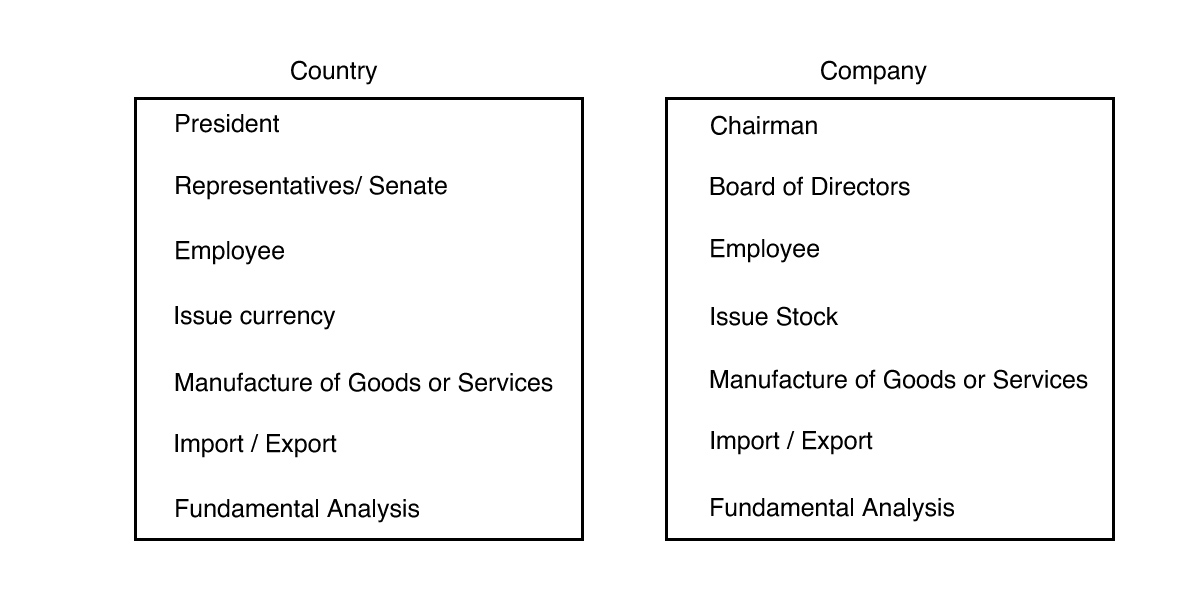

To a large extent, governing a country is akin to managing a business. The leaders of some countries are much like the chief executive officer or chairman of the board of directors of a company.

Other countries are led by governing bodies, such as lower houses, senators, or parliaments—similar to a company’s board of directors. Just as companies provide goods or services for consumption, countries do the same (see the figure below).

If a company grows and prospers, its stock value typically increases. Conversely, if a company accumulates too much debt, faces a couple of tough years, or stagnates due to poor leadership, its stock value will decline. The same applies to countries. If a country’s economic growth outperforms other countries, its currency will appreciate relative to theirs.

Now, let’s explore how fundamental data affects both countries and companies. When a company underperforms expectations, a high-ranking executive is caught embezzling, or the board chairman sells 80% of their stock holdings, the company’s stock price is undoubtedly affected. Investors begin to perceive that the management no longer cares about the company, eroding overall confidence and prompting them to sell their shares. When more people sell company stocks than buy, stock prices inevitably drop.

Conversely, if a company announces the development of a revolutionary product and plans to increase its workforce by 20%, investors become more excited. They start buying more shares, driving the stock price upward. This information about a company is known as fundamental data.

Countries and companies both have fundamental data that impact the value of their currency or stock. For example:

- A country reaching record-high unemployment rates or record-low housing starts.

- A prime minister resigning or a president being exposed for infidelity.

- A country’s economic growth outperforms others.

These events can suppress or boost the value of a currency. People become nervous when they perceive leadership turmoil, leading them to transfer funds from one country to another to safeguard their assets.

In fact, whenever investors become uneasy, they engage in financial activities known as hedging. By moving funds from one country to another, the currency of the former depreciates due to increased selling pressure, while the currency of the latter appreciates due to higher buying demand.

This parallels stock markets, where stock prices drop when selling pressure exceeds buying pressure. Therefore, if the market sells off US dollars and buys Japanese yen, the dollar will inevitably weaken, and the yen will strengthen.

If many investors think this way, they all engage in hedging—selling US dollars and buying British pounds. Consequently, the dollar weakens, and the pound strengthens.

Both companies and countries disclose data related to their overall operations, and investors react by adjusting their positions in currency or stocks based on this information. These economic indicators or reports are released monthly, quarterly, or annually, with some even published weekly.

While monthly, quarterly, and annual data are more critical, weekly data receives less market attention. All economic reports are listed in government financial calendars, providing publication dates, times, expected data, and previous values (see the table below).

You can find all the fundamental data or events that impact the forex market listed in the DailyFX Economic Calendar.

II. Fundamental Data Impact on Forex Trading

Typically, investors halt their trading activities just before the release of significant data. If the results are positive, the currency might rise, and vice versa. For safety, investors often wait for the data to be released before considering entering trades.

Seconds after the data is released, a flurry of buying or selling orders can enter the forex market, potentially causing sharp price movements in the short term.

For example, let’s say it’s 10 hours until the Federal Reserve Chairman is scheduled to speak about potential changes to the US federal funds rate at 2:30 PM Eastern Time. The Chairman’s speech could result in three possible outcomes: an increase in interest rates, a decrease, or no change at all. Let’s examine the potential outcomes and their implications.

-

Interest Rate Outcome: Rates go up, increasing borrowing costs. Higher borrowing costs reduce the inclination to borrow. Impact: Demand for the dollar may decrease, and the number of buyers for the dollar may reduce, leading to a depreciation of the dollar.

-

Interest Rate Outcome: Rates go down, decreasing borrowing costs. Lower borrowing costs enhance the inclination to borrow. Impact: Demand for the dollar may increase, and the number of buyers for the dollar may rise, leading to an appreciation of the dollar.

-

Interest Rate Outcome: Rates remain unchanged. Impact: The value of the dollar remains unaffected and stable.

Changes in interest rates can cause corresponding fluctuations in currency values. If you are an investor who monitors economic indicators worldwide and is prepared to trade forex based on interest rate changes, you are a fundamental trader. If you trade based on chart analysis candlestick charts methods, you are a technical trader.

To be a successful trader, you need to balance fundamental and technical analysis. However, most of the world’s successful traders are technical traders, not fundamental traders.

I vividly remember a call from a neighbour a few years ago asking for my help.

I said, “I’ll do my best. What’s the situation?”

He replied, “I currently have about $300,000 worth of Microsoft stock. It was worth around $500,000 at its peak, and now it’s back near $300,000. I don’t want it to keep falling.”

I answered, “Not to blame you, but are you calling me to drive the stock price up? I’m a forex expert, not a stock guru, you know.” I said this with a chuckle.

But he was serious, “You know, the US government has accused Microsoft of antitrust violations, and the judge is going to rule on Monday morning.” He continued, “Can you take a quick look at Microsoft’s stock chart and help me out?”

I asked, “What do you want to know?”

“Can you tell me whether to sell or hold?”

I said, “You’re joking, right? That’s a tough one. If I get it wrong, you might burn down my house. If I get it right, you’ll drive by my place in a new Mercedes on your way to a fancy dinner and won’t bother with me.”

We both laughed, “Give me some time, I’ll look at Microsoft’s stock chart.” As I searched for the chart, I thought about how he had invested $300,000 in a single stock, which had surged to $500,000. Who knows what else he held, but even so, he wasn’t willing to spend time learning the technical knowledge of chart trends.

He openly admitted that the stock had retreated $200,000 from its peak. I figured that spending time learning about trend lines, their breakouts, and buying and selling zones might have already saved him $200,000.

After reviewing the chart, I told him, “My view is that the judge’s ruling on Monday might be favorable for Microsoft.”

“You’re kidding, right?”

“Maybe, maybe not.”

“Come on, be serious, help me out. You have expertise in this area, and I don’t.”

I said, “Listen, this is truly my analysis. I believe the judge’s ruling might favor Microsoft because technically, Microsoft’s stock has broken through the downtrend line and entered the buying zone. It has encountered resistance and is now forming an ascending pattern, currently at the 0.618 Fibonacci retracement of the C wave, and a beautiful morning star pattern has formed.”

“Great,” he said sarcastically, “I don’t understand a word you’re saying. But you think I should hold, right?”

I said, “No, that’s not what I mean.”

“Sell it all today?” he said, disheartened.

I quickly said, “No, that’s not what I mean.”

He yelled at me, “What should I do then? I can’t stand it if it keeps falling.”

Finally, I calmly said, “The reason I’m confident that the ruling will be in Microsoft’s favor is that I believe nature does something in advance to maintain balance. Just like in this case, the chart has already told traders what the market is likely to do next.”

He interrupted, “Really?” His tone was as if he thought I was high.

I continued, “Regardless, a tornado could appear at any moment.”

Without pausing, I went on, “Now, let’s talk about my trading thoughts. As I mentioned earlier, I analyze that Microsoft’s stock will rise after the judge’s ruling, so I’ll continue to hold my current position. However, I’ll set a stop-loss near $2 below today’s trading price per share. If the stop-loss is triggered, I’ll sell half and keep the other half as a long-term investment. We both know Microsoft isn’t going to shut down anytime soon.”

As it turned out, the information revealed by the chart was correct, which surprised him, but not me. The judge ruled in favor of Microsoft, and the stock price soared like a rocket.

He indeed drove off in a new Mercedes to a fancy dinner, while I stayed home. After that, I never heard from him again.