I. Draw Support Levels and Go Long (Buy) in Forex Market

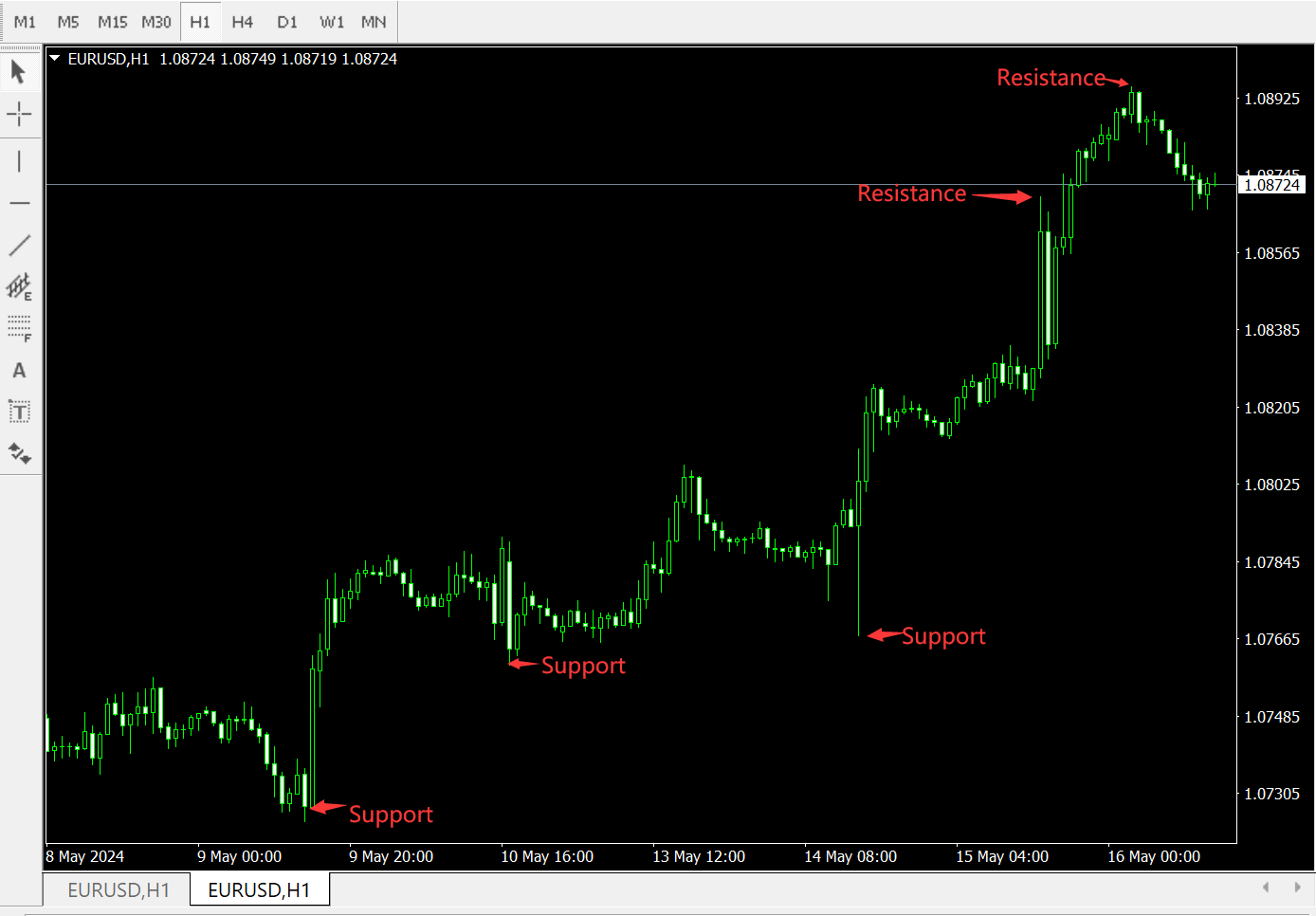

When bearish pressure drives the market down to a level lower than the previous low, bulls (long traders) become active buyers. The market attracts more buyers than sellers, interrupting the downtrend’s momentum, and prices rebound from that low point, creating support. The new low point becomes a fresh support level, where long traders start buying and disrupt the downtrend or price level in the forex market (see the diagram below).

The concept of “buy low, sell high” varies for each long trader. For instance:

For you, it might mean buying a commodity at $10 and selling it at $15. I might buy the same commodity at $7 and sell it at $30.

Regardless of the specific prices, both scenarios involve buying low and selling high. However, if you trade seven times a day and make $35 each time, you’re engaged in “scalping.” On the other hand, if I trade only once a day and make $23, or twice a day for $46, I’m practicing day trading. Ideally, we might buy at the low point of an upward U-shaped reversal and sell at the high point of a downward U-shaped reversal, but such ideal situations are rare. Most successful forex traders focus on trading during trend formation and sustained movement rather than trying to buy at the absolute lowest point and sell at the highest.

Next, I’ll highlight where and when to enter the market and the reasoning behind it—all based on logic and knowledge. Recognizing potential low and high points that may form in the future will help you identify entry and exit opportunities.

Long traders aim to drive the market to higher levels, get green pips after buying low. Therefore, identifying the potential targets for long positions is crucial. By examining current levels and historical trends, you’ll find that past highs and key resistance levels serve as potential targets for long positions, akin to climbing stairs upward (see the image below).

As a forex trader, once the bulls gain control of the market or wrest control from the bears, the key resistance level becomes the bulls’ upward target. When the market reaches the previous resistance and establishes new higher highs, there is often a pullback (see the chart below), driven by two main reasons:

-

It could be due to protective stop-loss orders placed by bears near the previous high. Once the bulls drive the price into this area, it triggers a significant amount of stop-loss buying, but there may also be substantial selling pressure. While the bulls may briefly dominate, the bears start reclaiming lost ground, leading to a retracement or decline. Typically, the exchange rate continues downward until buying interest re-enters the forex market. Normally, the bulls consider supporting the exchange rate at one of the following three levels:

a. Past support levels

b. Near the uptrend lines

c. Fibonacci retracement levelsSometimes, these three levels align perfectly, resulting in a phenomenon known as the ‘confluence effect.’

-

The market may also pull back due to reaching Fibonacci extension levels. If the previous resistance level is breached, allowing the uptrend to continue, the bulls become more involved, buying heavily near recent lows or support levels. The first support level becomes a critical area for entering long positions, especially if bullish candlestick patterns appear in that vicinity.

II. Draw Resistance Levels and Go Short (Sell ) in Forex Market

Short sellers aim to push prices down so they can buy low and sell high, just as your friend wants to sell their house to you at a reasonable price.

Imagine your friend says, “I’d like to sell my house to you for $180,000. Anything above that price is your profit.” You agree to buy the house at $180,000, with the intention of selling it at a higher price. You both agree that you have two months to find a buyer, and during that time, you can actually buy the house from your friend and then sell it to the buyer. As long as you sell the house at a price higher than $180,000 within those two months, you’ll make a profit. Suddenly, a buyer offers $220,000. Now you accept the buyer’s $220,000, commit to selling the house, and then buy it back from your friend. To secure your profit, you sell first at a higher price and then buy back at a lower price. In the financial markets, this behaviour is known as shorting the market, and it relies on the market moving in the direction you anticipate.

But what if the forex market moves against you? Let’s continue with the example: Suppose you couldn’t sell the house within the two months, and the real estate market starts collapsing. Still bound by the contract, you must buy the house from your friend at the agreed-upon price of $180,000. Later, you decide to sell it at $160,000 to avoid further losses. This time, you receive $160,000 from the buyer, commit to selling the house, and then buy it back from your friend at $180,000. Unfortunately, the market didn’t follow your direction, resulting in a loss of $20,000.

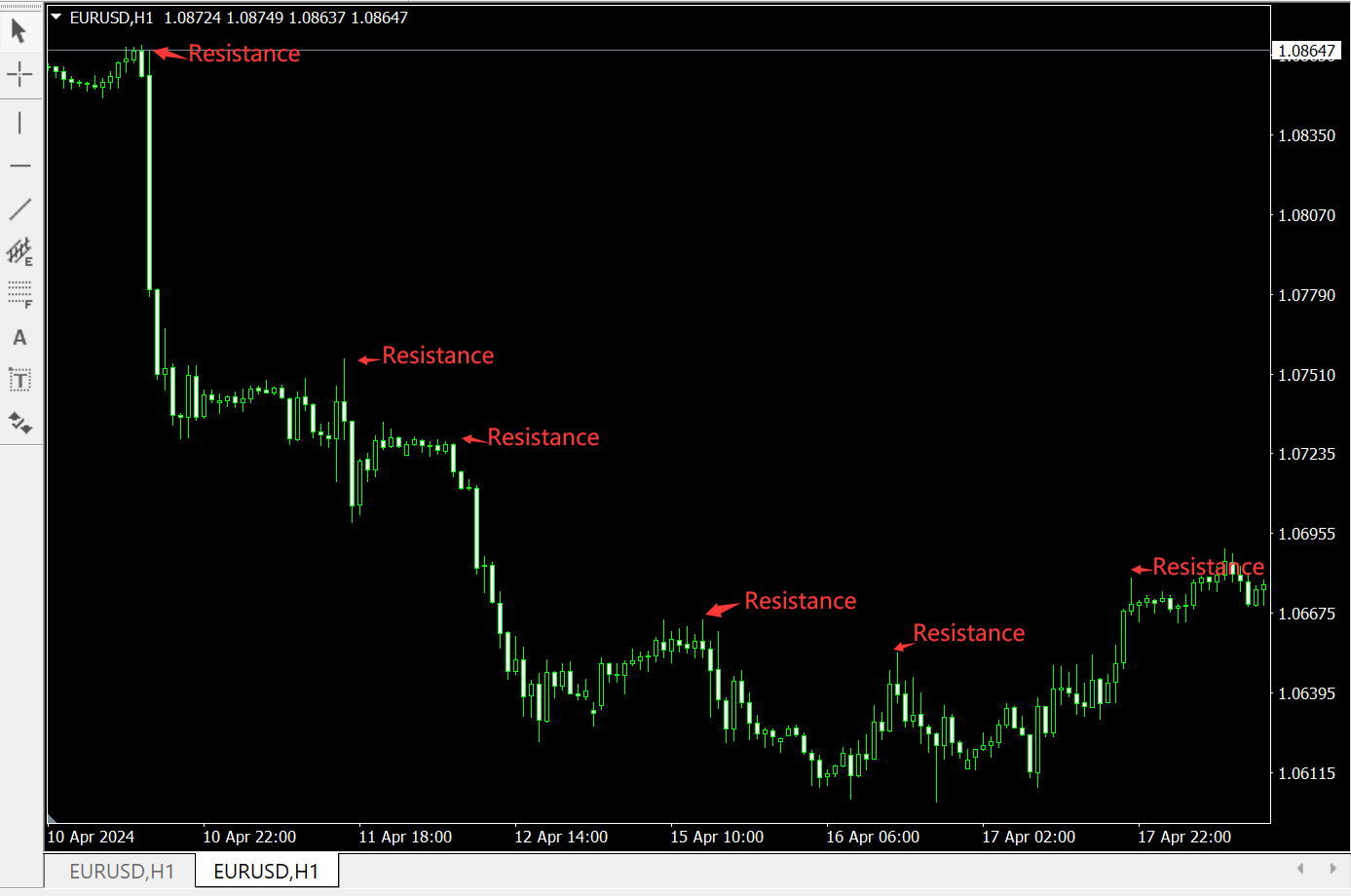

To avoid losses, it’s crucial to understand how to identify shorting opportunities. Look at current levels and historical trends—you’ll find that past lows and key support areas are potential targets for short sellers, much like descending stairs (see the image below).

Once short sellers gain control of the market or wrest it back from the bulls, critical support levels become their downward targets. After the market reaches previous support and establishes new lower lows, there is often a pullback (see the image below), driven by two main reasons:

-

It could be due to protective stop-loss orders placed by bulls near the previous low. Once bears push the price into this area, it triggers a significant amount of stop-loss selling, but there may also be substantial buying interest. While bears may briefly dominate, bulls start reclaiming lost ground, leading to a rebound or upward movement. Typically, the exchange rate continues upward until selling pressure re-enters the market. Normally, bears consider suppressing the exchange rate at one of the following three levels:

a. Past resistance levels

b. Near the downtrend lines

c. Fibonacci retracement levelsSometimes, these three levels align perfectly, resulting in a phenomenon known as the “confluence effect.”

-

The forex market may also pull back due to reaching Fibonacci extension levels. If past support levels are breached, allowing the downtrend to continue, short sellers become more involved, selling heavily near recent highs or resistance levels. The first resistance level becomes a critical area for entering short positions, especially if bearish candlestick patterns appear in that vicinity.