The field most closely related to the holistic concept and complex systems is cybernetics, one of the greatest scientific achievements of the 20th century.

Many new concepts and technologies in modern society are closely linked to cybernetics. Cybernetics is the product of the interpenetration of various disciplines such as automatic control, electronic technology, radio communication, computer technology, neurophysiology, mathematical logic, and language.

It studies the characteristics of communication and control common to all types of systems, whether machines, organisms, or societies. All these systems adjust and determine their actions based on certain changes in their environment. The founder of cybernetics was the American mathematician Norbert Wiener.

Now, cybernetics has seen many significant developments, but Wiener’s idea of using Gibbs statistical mechanics to handle certain mathematical models remains central. He defined cybernetics as having two state variables, one of which we can adjust, and the other we cannot control.

In forex trading, the variable we can control is “our lot size,” while the uncontrollable variable is “the price of the financial instrument,” such as the forex quote. When you learn to think about your relationship with the forex market using the mindset of cybernetics, you will step up to a new level in forex trading, and thus gain a holistic view.

The holistic concept tells us to see the forex trader and the market as a whole, just as we discussed earlier the determinants of trading performance are the behaviour led by the forex trader’s concept and the movement of the market itself. To see only the changes in the forex market and ignore the profound impact of the trader’s concept on trading performance is to violate the holistic concept.

Likewise, the market itself is a whole, whether it’s the participants or the various links in the mechanism of price movement. From the gradual driving of fundamental events to the absorption and anticipation at the psychological level of forex traders, the inflow and outflow of funds, and finally the change in exchange rates, which in turn affects the judgment of smaller capital forex traders, further accelerating the current trend of exchange rates, and so on in a cycle.

However, the ultimate determinant of the main trend of exchange rates is the driving factors, that is the fundamentals and the direct cause of the mainstream trend are large capital forex traders and the real economy. If you look at this series of forex fluctuation mechanisms and triggering links separately, you are to some extent going against the holistic concept, and the ultimate goal is to let you penetrate all aspects of forex trading.

Even in technical analysis, there are many specific applications of the holistic concept, some seemingly trivial details, but they have a crucial impact on your trading.

In forex intraday trading, we focus on the recent and current trends of exchange rates, as shown in the chart below, which we call the “short-sighted view.” Once your focus narrows to the recent and current trends of exchange rates, you undoubtedly violate the holistic concept, and from another perspective, you lose the advantageous angle of grasping the “momentum.” The ups and downs of the current exchange rate have completely captured your thinking, and you have unknowingly stepped into the trap set by the market.

If you can adhere to the requirements of the holistic concept, you should switch between the zoomed-in and zoomed-out views from time to time, so you can both stand at the height of the overall situation to see the trend of market development and get involved in the local opportunities for entry and exit, which is a common trait of outstanding forex intraday traders.

If we only look at the “short-sighted view,” we become shortsighted; if we only look at the “far-sighted view” (see the chart below), we become farsighted. If we combine the two, we can compensate for the defects of both and gain the advantages of both. “Not falling on either side, holding the middle view,” we need such an observation strategy, but more forex traders tend to look at the local, the recent, so “farsightedness” is a habit that we need to deliberately cultivate.

Looking at the GPUSD M5 enlarged chart, the British pound against the US dollar seems to have a strong upward trend, but if you can look at the bigger “scene,” as shown in Figure 1-6, you will find that the current trend of the British pound against the US dollar is more like a 0.5 retracement in a downtrend. That is to say, if you give up the bigger background, you often stand on the wrong side of the trend, which is very scary.

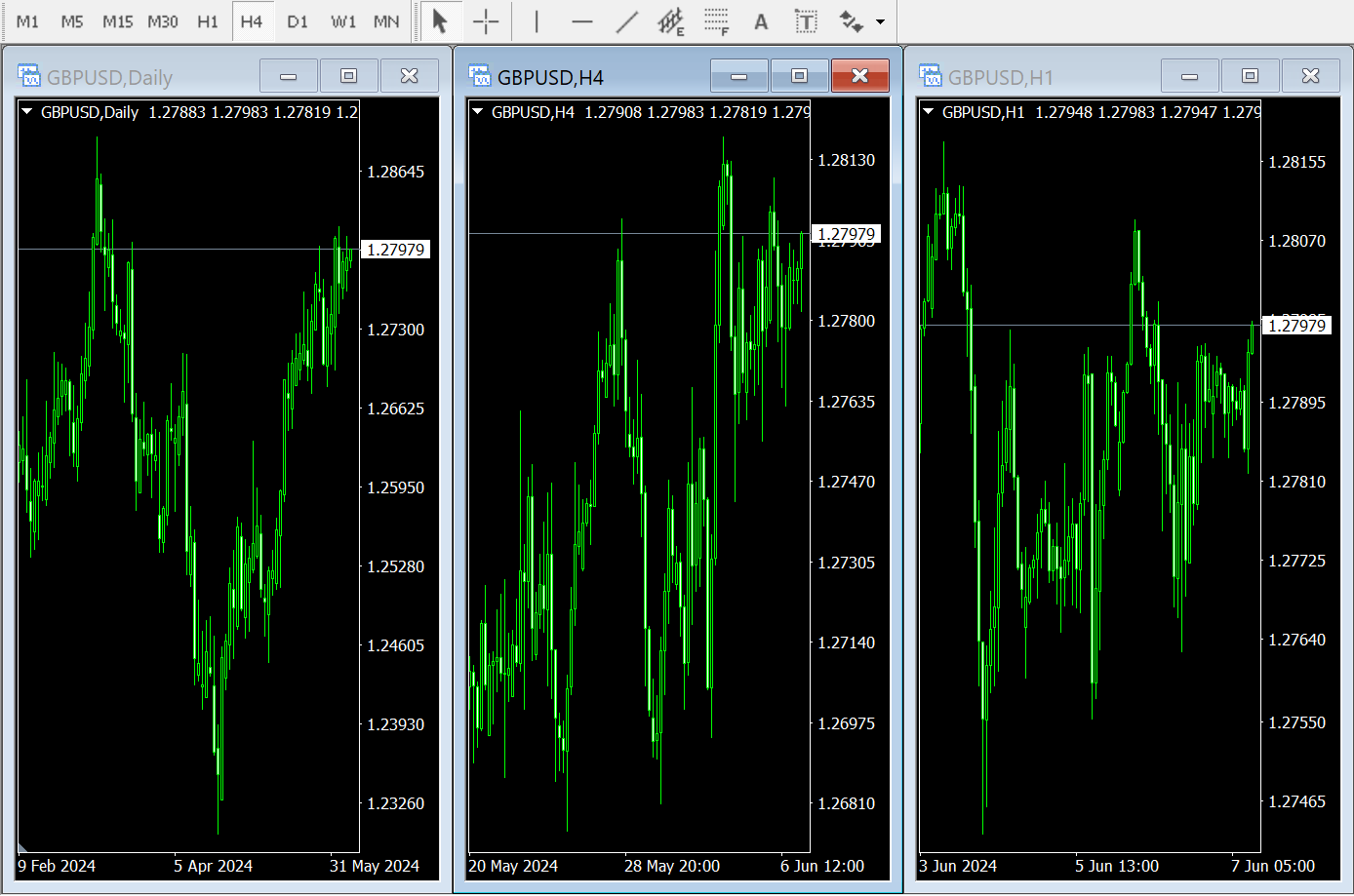

To allow the holistic concept to play a greater role, we should use a multi-screen system, generally a three-screen system, which simultaneously displays the market trends of two-time levels higher than the actual entry and exit on one interface, as shown in the chart below. In the chart below, the far left is the daily trend, the middle is the 4-hour trend, and the far right is the 1-hour trend.

The three together clearly show the relationship between the various levels of the British pound against the US dollar. One of the core tools of the so-called “Adam Theory” is to let us see the development of the market from a larger range.

There are many forms of the specific practice of the holistic concept in forex trading, and the three-screen system is just one of the simpler and more important ones. Its most fundamental manifestation is still systematic trading.

Systematic trading does not equal mechanical trading; systematic trading means that all aspects of the trading process must be complete, smooth, and optimized, with each link in the trading process taking into account the others.

Many forex traders’ methods cannot even talk about the most basic completeness: most only have market analysis without funds management steps; the rest only have entry plans without exit plans; some have exit plans, but the exit strategies and methods are very single, not systematic and complete.

A forex trader who can achieve sustained success must have the ability to trade systematically, while a forex trader who fails in the long term and occasionally succeeds certainly does not have the ability to trade systematically.

There are many methods of trading, but in the end, they are nothing more than the implementation of the four words “entry, exit, add, subtract.”

How to better implement them involves market analysis and position management steps. “Entry and exit” is the simplest systematic thinking, and most stock and forex traders do not have the systematic thinking of “entry and exit.”

A few have the thinking of “entry” but not “exit.” Here, “entry” is not as simple as entering the market, but refers to specific entry conditions or entry points; here, “exit” is not as simple as exiting the market, but refers to specific exit conditions or exit points.

A slightly more advanced trading system involves “entry, exit, add, subtract,” in addition to the sufficient and necessary conditions for entry and exit, it also considers the issues of adding and reducing positions in the middle.

There are many methods of trading, but in the end, they are nothing more than the implementation of the four words “entry, exit, add, subtract.”

How to better implement them involves market analysis and position management steps. “Entry and exit” is the simplest systematic thinking, and most stock and forex traders do not have the systematic thinking of “entry and exit.”

A few have the thinking of “entry” but not “exit.” Here, “entry” is not as simple as entering the market, but refers to specific entry conditions or entry points; here, “exit” is not as simple as exiting the market, but refers to specific exit conditions or exit points.

A slightly more advanced trading system involves “entry, exit, add, subtract,” in addition to the sufficient and necessary conditions for entry and exit, it also considers the issues of adding and reducing positions in the middle.