Forex trading involves five steps. The first step is market analysis, which is divided into three steps. For forex trading, the first two steps of market analysis are not essential, but if done, they can greatly benefit your trading. However, doing them incorrectly is worse than not doing them at all. Being a pure technical analyst may yield conservative but relatively stable performance.

Market analysis is divided into three steps. If you talk to most beginners and even experienced forex traders about customizing trading plans, executing them, and managing risk, they might get impatient. They want to know the “secrets to predict price direction,” like a magical indicator or a 100% accurate market analysis system. Without these, they might settle for rumours from a market soothsayer.

Indeed, market analysis is the most complex and fascinating part of trading and the most creative. However, this doesn’t mean that other simpler and more rigid parts are less important. On the contrary, they may even be more important than the market analysis itself.

For most forex traders, it’s correct to emphasize the importance of non-market analysis aspects. For those who already have basic profitability, the importance of market analysis should be stressed. Of course, if you really want to become a top forex trader, you should excel in all aspects of the trading process, blending personal creativity with objective rules (market rules, capital management, and psychological rules).

Failed forex traders have significant common characteristics. You can tell a trader’s potential and current strength as soon as they speak. Most failed traders typically ask questions like:

-

Which currency should I buy for a medium to long-term hold? Please advise.

-

The Canadian dollar suddenly plummeted during the session, approaching 1.04. Should I buy on the dip for a short-term trade?

-

Should I close my short position on gold at 1141, which was opened at 1156?

-

I bought USD/JPY at 91.85 today; do I have a chance to break even?

-

Will the euro reach the support level of 1.4420 tonight? Thank you for your explanation!

-

Our central bank decided to raise the reserve requirement ratio by 0.5 percentage points. Does this have any relation to the yen? Is the yen under pressure because of this? Thank you!

-

Has the A-B-C correction wave of this gold rebound finished, and can it surge to the 0.618 Fibonacci level of 2305? What is a reasonable frequency for real trading? Thank you!

-

The EUR/JPY cross seems to have the largest drop today. Is it possible it will correct to below 160? Last week it dropped to 160.3 before rebounding, and today it seems to be following the same trend. I placed a short order at 162; do I need to stop loss? I made a mistake; it was supposed to be a buy order, not a sell. Can you analyze this for me?

-

China raised the reserve requirement ratio; will this affect the Australian dollar trend?

-

Is it a good time to exchange my Swiss francs for US dollars? Thank you!

These questions reflect a common notion: as long as you figure out the market’s ups and downs, trading is easy. Digging deeper, there’s a belief that the market’s movements are highly certain, and there exists a method that can efficiently predict future rises and falls and an authority that possesses this method.

Typically, market analysis is considered the entirety of the forex trading process. Most people think that once the market analysis concludes, placing an order is extremely simple. In reality, market analysis is just a superficial layer, merely the first step of trading.

The development of market commentary has gradually shifted from analysis (by analysts) to specific operational guides (by traders). The first type of commentary is traditional and analytical, generally not involving entry and exit points; the second type, which has emerged in recent years, is guide-oriented and provides specific entry and exit points.

Analytical commentary is suitable for mature traders to reference, but not so much for beginners. Overemphasis can harm beginners, misleading them and keeping them outside the real doors of forex trading. Guide-oriented commentary is easier to track performance, is falsifiable, and belongs to a scientific trading method. Under the guidance of such commentary, beginners can step into the real world of forex trading. Even if the performance is not ideal, it lays a solid foundation in the framework and habits of trading, which is much more useful than flashy market analysis.

In the early Asian session, GBP/USD continued its retracement trend, pressured by comments from CIC officials, and fell to around 1.6060. However, GBP/JPY found strong support and rebounded to 1.6110 before the European session opened, close to the Asian opening level. During the European session, UK trade data was slightly better than expected, and the price found support near the 20-day moving average, rebounding to the 1.6160 level, currently slightly down near 1.6120. Technically, GBP/USD has limited room for further rise, with short-term resistance still at 1.6200, and short-term risk sentiment will continue to be the key driving factor.

The second commentary “GBP/USD” strategy: sell at 1.6050; target: 1.5450; stop loss: 1.6250. Last week’s bearish reversal pattern seems to end the rebound from 1.5832 at 1.6240. As long as the price stays below last week’s high of 1.6240, I believe it will break the psychological barrier of 1.6000, increasing the risk of probing the external weekly chart support at 1.5832 and the swing low at 1.5706. Breaking the latter will confirm a large head-and-shoulders pattern, initially pointing to 1.4985. Additionally, if it rises above 1.6240 again, it suggests an intensified rebound to 1.6271/1.6418, but a first-time breakthrough of resistance at 1.6515 is needed to hope to return to 1.6878/1.7043, and after breaking through, it will rise to 1.7442/1.7500.

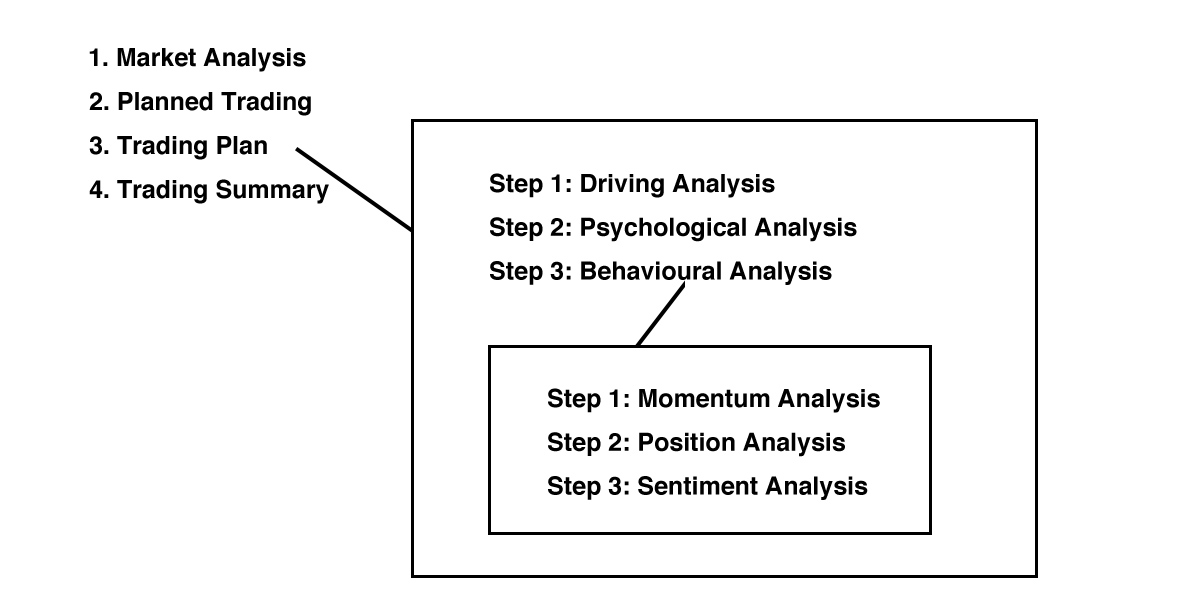

Market analysis is just a small part of trading. Real trading, excluding summary and performance optimization, includes at least four steps, as shown in the figure below. General readers value market analysis, but our focus is on achieving a balance between market analysis and position management. Although market analysis involves many issues, we will tell you a different kind of market analysis, which is the “driving analysis - psychological analysis - behavioral analysis” holistic approach.

Personally, in intraday short-term trading facing many currency pairs, I generally use a quick judgment trading model, as shown below. If time is really tight, skip the first step and start from the second step. The third and fourth steps are essential and cannot be omitted. Ask yourself: how many times have you really spent time going through these four steps in forex trading?

Table 1-1: Quick Judgment Trading Model I Use

-

Step 1: Driving Analysis - Key Factor Certainty Structural Changes - Game Theory Payoff Matrix

-

Step 2: Psychological Analysis - Market Emerging Focus - Game Participants

-

Step 3: Behavioral Analysis - Fractals and R/S - Game Behavior Analysis

-

Step 4: Position Management - Kelly Criterion - Seeking Dominant Strategy