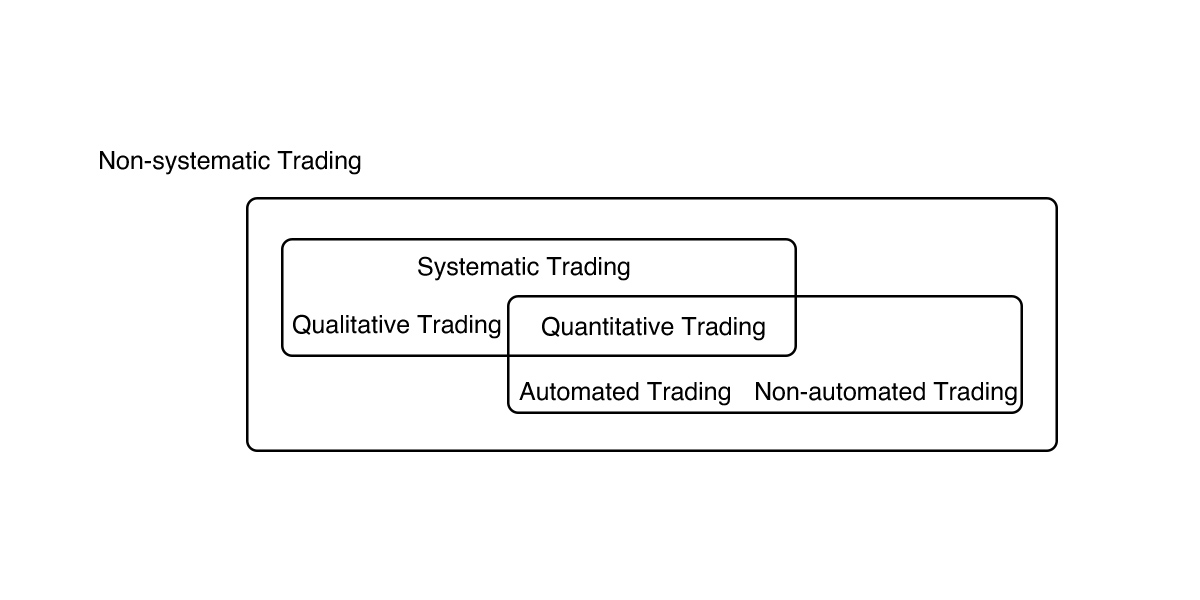

Mechanical trading, in strict terms, should be completely quantified, involving entry, exit, and position sizing. Fully quantified trading within system trading is mechanical trading, and the full automation of mechanical trading is intelligent or automated trading. The qualitative mode of system trading is generally the primary mode within system trading and can adapt to structural changes in the market background, but it has weaknesses due to subjectivity and emotional influence. Please refer to the figure below, trading methods are first divided into non-systematic trading and systematic trading. Non-systematic trading is an absolutely failed method in the long run, regardless of whether you use qualitative or quantitative methods, whether you analyze patterns or use indicators. Without the requirements of systematic trading, the final result is a failure.

Systematic trading is divided into qualitative and quantitative trading. Qualitative trading has less subjectivity than non-systematic trading but more than quantitative trading.

Non-systematic trading is more susceptible to emotional impact than qualitative trading, and qualitative systems are more susceptible to emotions than quantitative systems. However, the adaptability of qualitative systems is generally stronger than that of quantitative systems because qualitative system trading can take into account market characteristics or structural changes in the trading background, which is generally not recognized by most quantitative traders.

Quantitative trading systems are divided into automated mechanical trading and non-automated mechanical trading, with the difference being whether the final position management authority lies with the software or the trader. Automated mechanical trading can better overcome the emotional impact on traders and is, of course, also susceptible to statistical “fat tail” events. Advocacy is for qualitative system trading because some analysis methods that are very effective for market trend characteristics are currently difficult to handle completely quantitatively. Below we look at some simple examples of systematic trading.

The legend of Richard Dennis’s Turtle Trading Method is well known throughout the technical trading world. He and his disciples have been able to dominate the entire futures trading world with systematic trading thinking. The Turtle Trading rules revealed introduce the systematic requirements of trading as follows:

A complete forex trading system contains every decision needed for successful trading:

- Market - What to buy and sell

- Position size - How much to buy and sell

- Entry - When to buy and sell

- Stop loss - When to exit a losing position

- Exit - When to exit a winning position

- Strategy - How to buy and sell

-

Market - What to buy and sell

The first decision is what to buy and sell, or essentially, in which markets to trade. If you trade in only a few markets, you greatly reduce the chance of catching a trend. At the same time, you don’t want to trade in markets with too little volume or unclear trends.

-

Position size - How much to buy and sell.

The decision on how much to buy and sell is absolutely fundamental, yet it is often misunderstood or mistreated by most forex traders. How much to buy and sell affects diversification and capital management. Diversification is about spreading risk across many investment tools and increasing the chance of profit by catching successful forex trades.

Proper diversification requires similar trading on a variety of different investment tools. Capital management is actually about controlling risk by not trading too much so that you run out of funds before a good trend arrives. How much to buy and sell is the most important aspect of trading. Most novice forex traders take too much risk in individual trades, which greatly increases their chances of bankruptcy, even if they have an effective trading style in other respects.

-

Entry - When to buy and sell.

The decision on when to buy and sell is commonly referred to as the entry decision. Automated systems generate entry signals, which specify the precise price and market conditions for entering the forex market.

-

Stop loss - When to exit a losing position.

In the long run, forex traders who do not stop losses will not be successful. Regarding stop loss, the most important thing is to set the exit point before you establish your position.

-

Exit - When to exit a winning position.

Many “trading systems” sold as complete forex trading systems do not clearly state the exit of a winning position. However, the question of when to exit a winning position is crucial to the profitability of the system. Any trading system that does not specify the exit of a winning position is not a complete trading system.

-

Strategy - How to buy and sell.

Once a signal is generated, the mechanical aspects of the execution strategy become important. This is especially a practical issue for larger accounts, as the entry and exit of their positions may cause significant reverse price movements or market impact.

After Richard Dennis faded from the trading world, his disciples have always been the benchmark of the futures trading world, with their biggest advantage being adherence to the basic principles and steps of systematic trading. In addition to Richard Dennis, Paul Jones and Ed Seykota are also outstanding short-term traders. Jones tends to qualitative system trading, and the funds he controls far exceed those of the well-known Martin Schwartz.

Paul Jones is introduced to some extent in “The Bible of Forex Trading,” and here we mainly introduce Ed Seykota, who can be considered one of the forefathers of automated forex trading.

In the early 1970s, Ed Seykota worked at a large brokerage firm, designing and developing a computer trading program system. Due to frequent interference from management, the results were not ideal. Confident in himself, Ed decided to start his own business, trade for himself, and manage a small amount of funds, making trading decisions based on his computer trading program system.

Later, Ed created a miracle in the automated trading world with his mechanical trading system, achieving a thousand-fold increase in capital. After Ed, the more famous master of quantitative trading is James Simons. The Renaissance Technologies fund led by James Simons had an average annual return of 38.5% from 1989 to 2006. In contrast, the “Oracle of Omaha” Warren Buffett had an average annual return of just 20% over the past 20 years.”

Unlike many American fund companies, Simons’s company has few business school prodigies or Wall Street investment analysis veterans but is filled with a large number of mathematics, statistics, and natural science PhDs. Even Simons himself, before entering Wall Street, was a mathematician renowned in academia. Simons cleverly applied his mathematical theoretical background to practical stock investment. He screened billions of individual data points through computer models, selecting securities to buy and sell. By analyzing statistical information, he judged short-term price changes in forex and bonds, added risk control models and statistical arbitrage, traded a large number of stocks at high speed; introduced variants of statistical arbitrage, traded stocks at low speed; and continued to introduce other models, analyzing less commonly used data sources - this is Renaissance Technologies.

People call Simons’s trading method “quantitative trading.” Trading through computers can effectively eliminate human interference. Simons’s trading method focuses more on short-term arbitrage and frequent trading. Since its inception, the Renaissance Technologies fund has had an average annual return of 38.5%, and its assets have never decreased over the years. From 1988 to 2009, Berkshire Hathaway managed by Buffett had an annualized return of 17.4%; during the same period, Renaissance Technologies managed by Simons had an annualized return of 40.68%. What conclusions can you draw from this?

However, don’t forget that the scale of funds managed by Simons is much smaller than Buffett’s, and Simons believes that the funds operated by Renaissance Technologies should not exceed $100 billion, otherwise, it would not be possible to obtain sufficient position liquidity. James Simons’s quantitative trading is closely related to so-called “quants.” Quants are financial engineers, and their professional scope overlaps greatly with mechanical trading. The establishment of the International Association of Financial Engineers in 1991 represents both the formal advent of financial engineering and the recognition of financial engineers as a special group by society.